When India actively chose RuPay credit cards

RuPay was considered a late entrant in the digital payments space and was perceived as a local cousin to its global, seemingly cooler competitors, but its credit card had a feature that no other credit card in India offered – it worked on UPI. And in a country with 70 million merchants on UPI versus just 6 million point-of-sale terminals that accepted credit cards, it was a game changer.

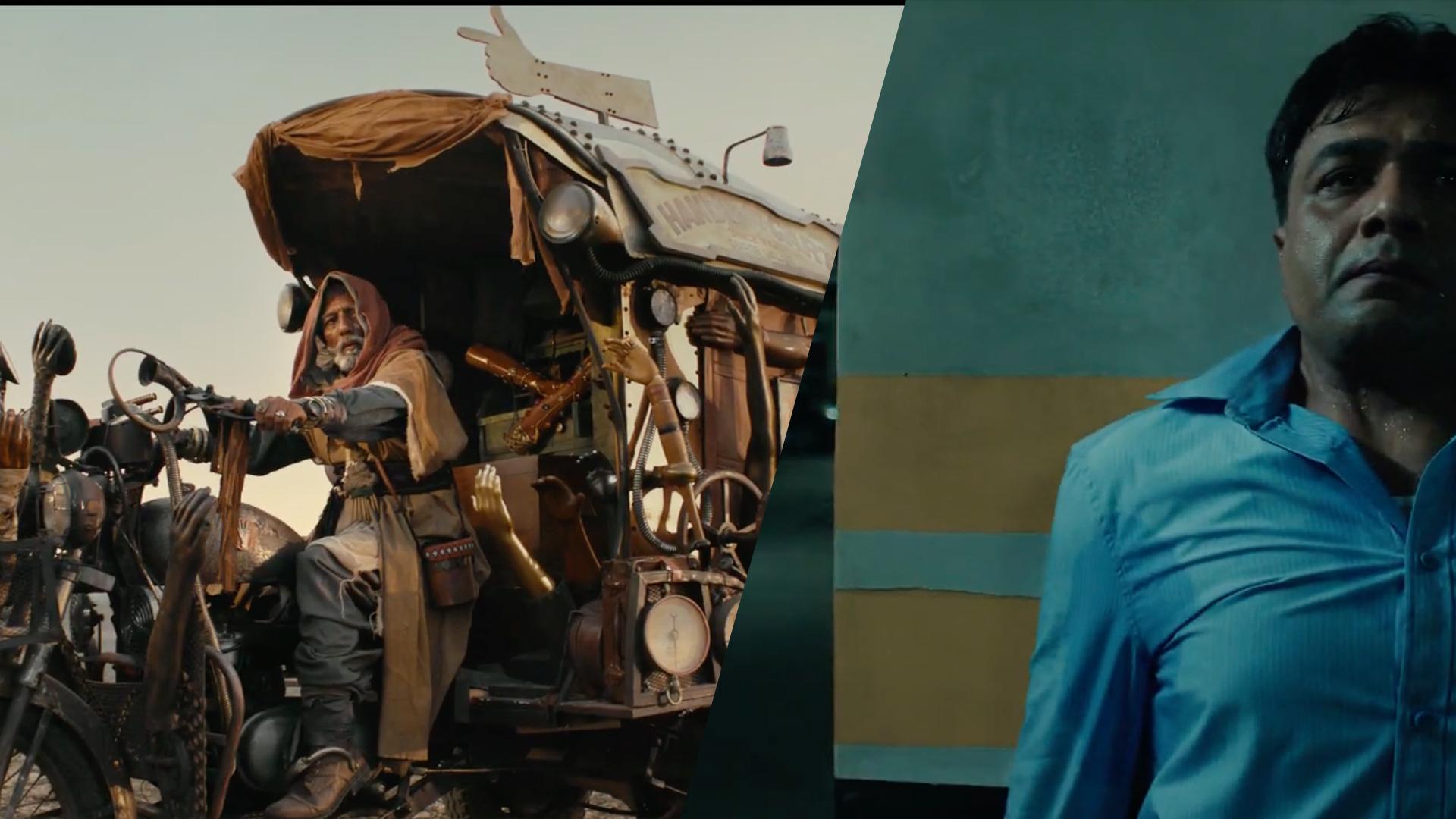

While our competitors were heavily going product first, we broke through the clutter by positioning the RuPay credit card as the one that gives you a line of credit which is more than just credit – it’s a lifeline. We launched it with a campaign that showed frustration of vendors rejecting credit cards that don’t work on UPI, in some hilarious and totally probable situations, during the biggest T-20 cricket league in the world – the IPL. With it, we asked people to make much-needed shift from passively going with their default credit card option, to actively choosing one that works better for them.

In 2023, the films reached around 33 mn+ unique audience and in a sea of ads playing during IPL, became one of most remembered, loved and talked about campaigns. What’s more, RuPay doubled its credit card issuance growth as compared to previous years, overtook the market leaders in brand consideration, and found its place in people’s wallets and hearts.